FOR IMMEDIATE RELEASE Media contact: Chris Sullivan MacMillan Communications

(212) 473-4442

ETF INDUSTRY LEADER LINDA ZHANG LAUNCHES PURVIEW IMPACT SOLUTIONS

New firm will provide actively managed portfolios of ETFs; the initial product - Purview Impact Solutions - will focus on global investing through ESG lenses

NEW YORK (January 17, 2018) – Linda Zhang, Ph.D. and ETF industry leader, is today formally announcing the launch of Purview Investments, a new provider of high-quality ETF research and actively managed Exchanged Traded Fund (ETF) portfolios.

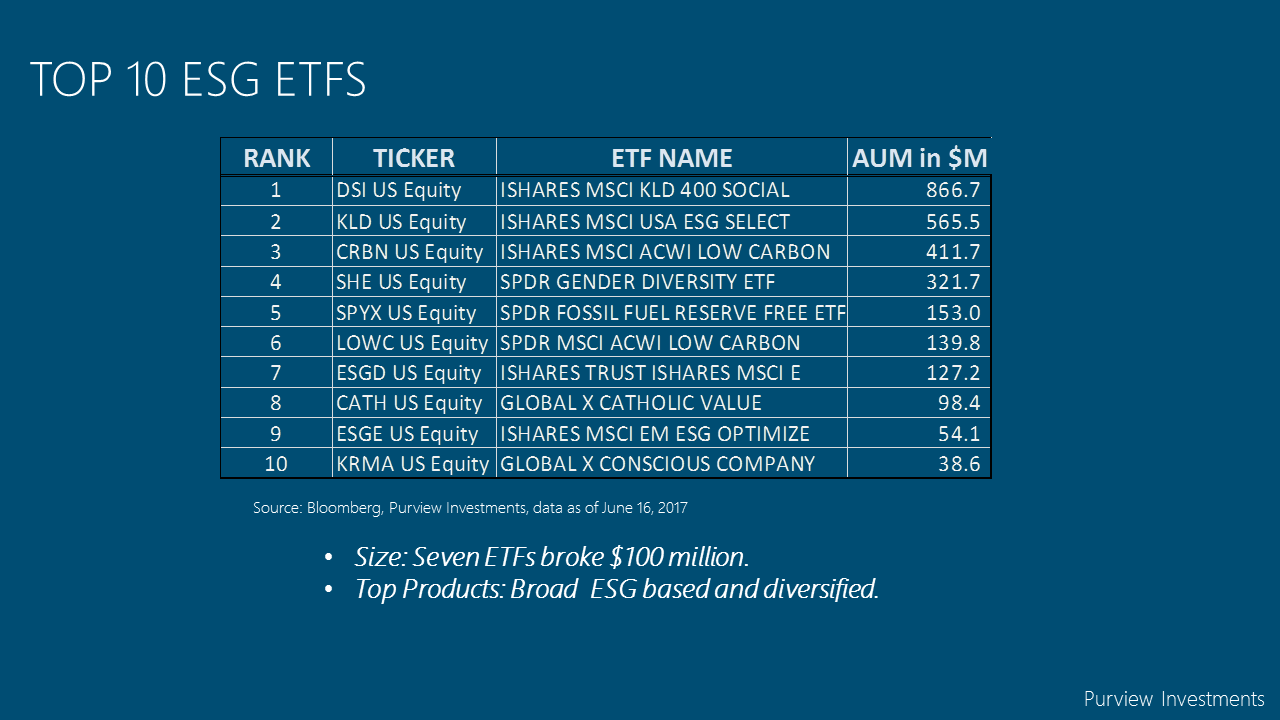

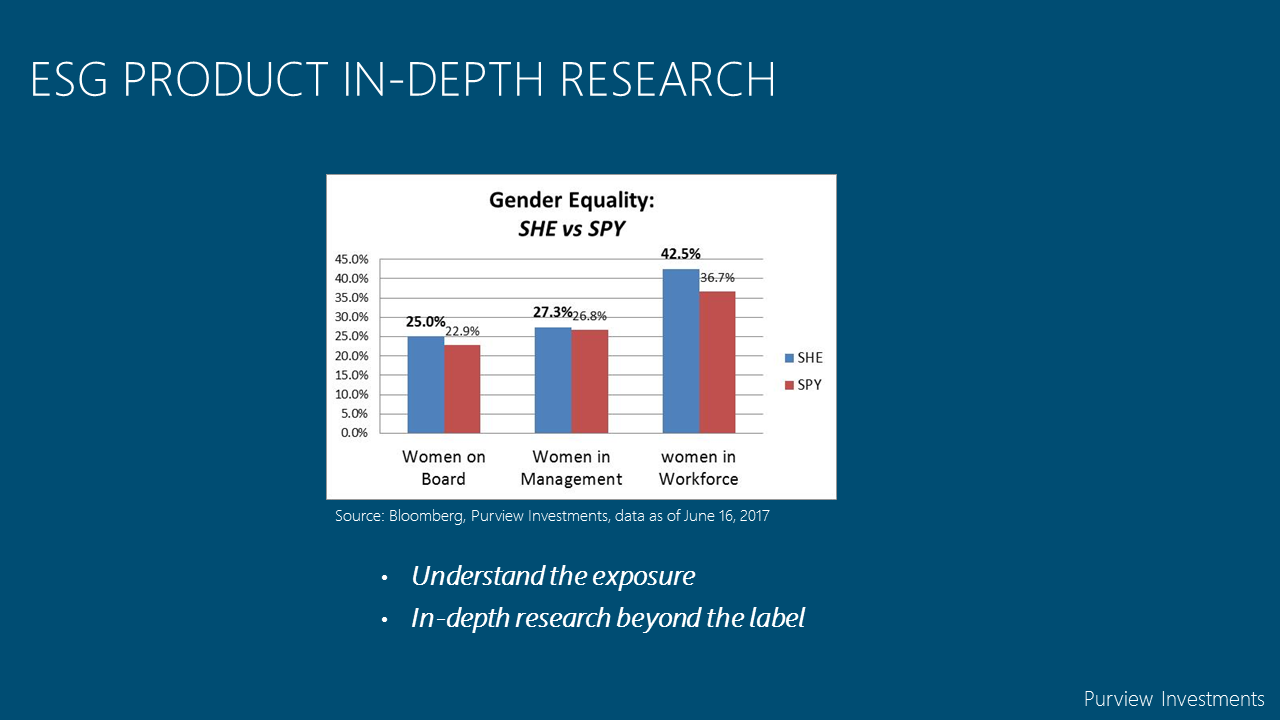

Purview’s initial product, Purview Impact Solutions, is a global multi-asset product built using primarily environmental, social and governance (ESG) ETFs as the underlying holdings. It will provide clients the opportunity to invest in companies around the world that are screened according to industry accepted ESG criteria. The investment solution is managed using Dr. Zhang’s proprietary research and process.

Dr. Zhang has built a successful career in the asset management industry and has spent the last several years focused on the fast-growing universe of ETFs. Prior to founding Purview, Dr. Zhang was Head of Research and Senior Portfolio Manager for Windhaven Investment Management, where she was responsible for portfolio management and led the firm’s research team in areas of global macro research, model development, ETF research and implementation. Before that, she held fund manager positions with MFS Investment Management and BlackRock, and was the head of Quantitative Research at State Street Research. Her background includes years of investing in global markets and analyzing how ESG principles can potentially have a positive impact on a portfolio through the use of ETFs.

“The rise of the ETF industry has fundamentally changed the way people invest and continues to reshape asset management. It has been a fascinating and fulfilling journey to experience. I am very excited to be embarking on my next chapter with the launch of Purview Investments and to introduce the first of what I expect to be a number of innovative new products,” said Dr. Zhang.

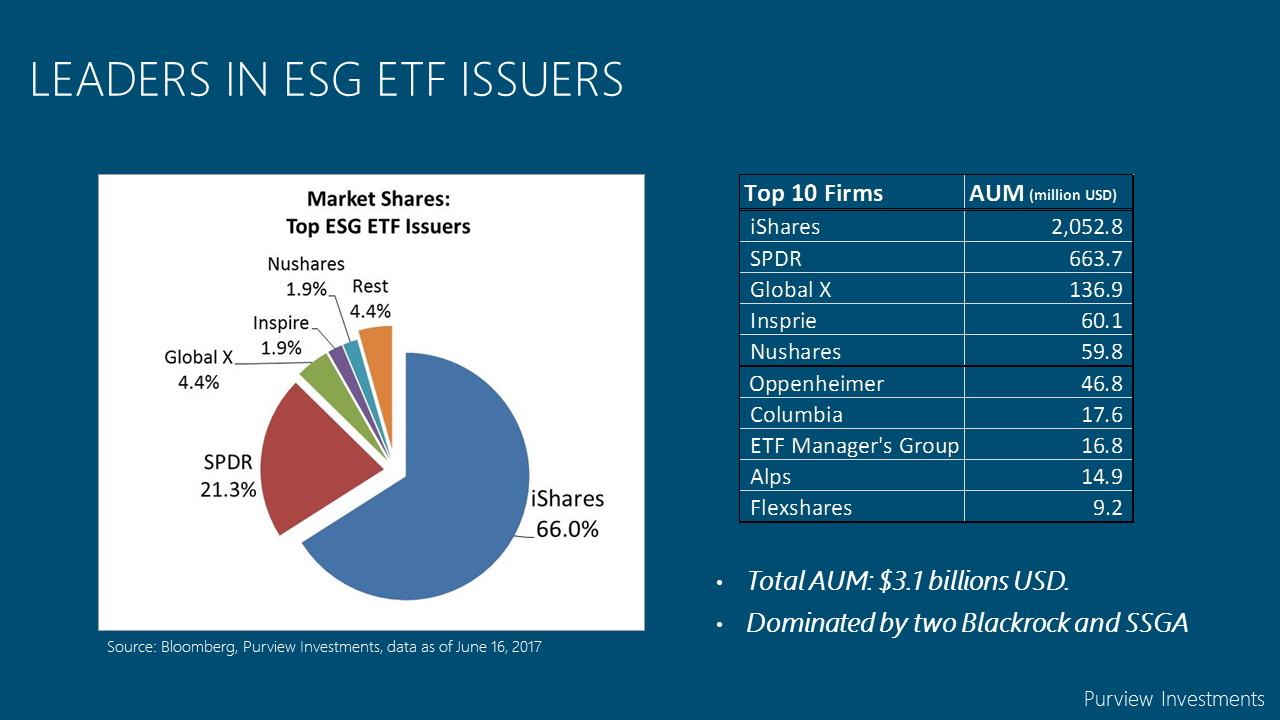

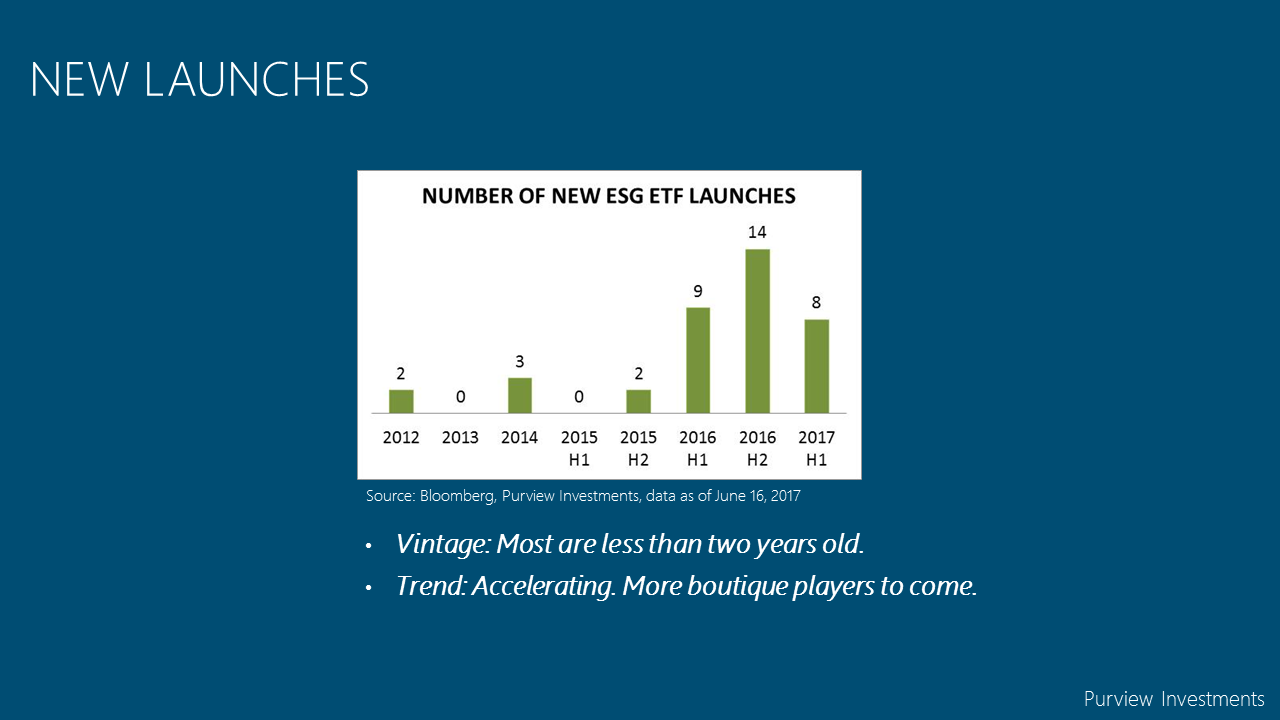

Dr. Zhang notes that while the ETF industry has done a remarkable job in building a wide menu of fund choices, what’s largely been missing is the means to bring all of the ingredients together through the active allocation of assets across funds. While robo advisors offer easy access to ETF managed portfolios, they are largely strategic in nature regarding allocation decisions among ETFs, rather than taking active views on various segments of markets. There are even fewer options available in the marketplace when it comes to aligning investments with an investor’s beliefs in ESG principles. “There is a rising demand for ESG focused investing, with US listed ESG ETFs increasing their AUM by about 25% in just the second half of 2017. Purview is committed to addressing this void and being a leader in the space by assembling individual ESG ETFs into well-researched and managed global multi-asset investment solutions,” said Dr. Zhang.

In addition to her work at Purview and other collaborations in the ETF universe, Dr. Zhang is a co-founder of Women in ETFs, which in just a few short years has grown to more than 3,000 members from around the world who work in the ETF ecosystem. She is a board member and most recently served as co-Head of the Global Mentorship and Leadership Committee.

Purview Investments opens its products to individual investors, RIAs, family offices and institutional asset owners. To learn more about Purview Investments, please visit https://www.purviewinvestments.com or email info@purviewinvestments.com.

About Purview Investments

Purview Investments, is an independent investment management firm, a Registered Investment Advisor, a provider of Exchange Trade Fund (ETF) managed solutions and in-depth ETF research based in Manhattan, New York City. As ETFs are reshaping the asset management industry, driven by investors' preference for effective and transparent investment products, Purview Investments seeks to provide research and process driven actively managed ETF solutions to both individual and institutional investors directly. In addition, Purview seeks to collaborate with ETF providers, index provider, institutional asset managers, investment advisers and asset owners to develop customized ETF managed solutions and on ETF product innovation. Purview Investments dedicates itself to public knowledge and education of ETFs by contributing to industry conference panels, business media and professional publications.