Purview's Zhang participated as a speaker at the inaugural Inside ETFs Asia, the mega ETF conference's first attempt in Asia during November 8 and 9, 2017. "10 in 20" has become a popular session hosted by the conference organizer and an industry veteran Matt Hogan, where the interviewee had to answer 10 questions in 20 minuets. Zhang was grilled with questions from the global experiences with inverse ETFs to the role of robo-advisors vs active management in the ETF managed solution space. They also discussed global market outlook and where to invest in 2018.

"'The Davos for ETFs' to Convene in San Sebastian", Financial Times, September 14, 2017

Zhang was quoted in the article regarding the need to educate the market place about ETFs as the industry is growing rapidly. "The industry is finding its voice", said Zhang, referring to the informal gathering of thought leaders in the ETF ecosystem.

Women in ETFs News Release highlights career and mentorship program offered to its members, and benefits to its corporate sponsors, September 12, 2017

Women in ETFs New Release highlighting mentorship program, WE Talks webcast and other services offered to its members. From the release:

Linda Zhang, Co-Founder of WE and Co-Head of the Mentorship & Leadership Committee, cited “25% of WE members indicate they would like to have a mentor and 16% would like to be a mentor. WE is addressing these needs by raising awareness and providing actionable ideas such as one-to-one Mentorship Programs, currently being piloted in Boston, Chicago, and in the EMEA region, and by using technology to deliver career advice in webcasts globally such as in our WE Talks series.”

Joanne Hill, WE Co-Founder and Career Center task force leader shared that “We are excited to allow for complimentary access to all WE sponsors and Event Hosts to post jobs to our Career Center, accessing our talented and diverse pool of members.”

A Bloomberg Interview: "Performance Versus Principles: Purview's Zhang on `Secret Sauce' ESG ETFs", August, 2, 2017

ESG ETF Who's Who: Purview Investments' Linda Zhang spoke on the state of ESG ETF industry at IMN Global Indexing and ETFs Conference at Dana Point, CA, June 25, 2017

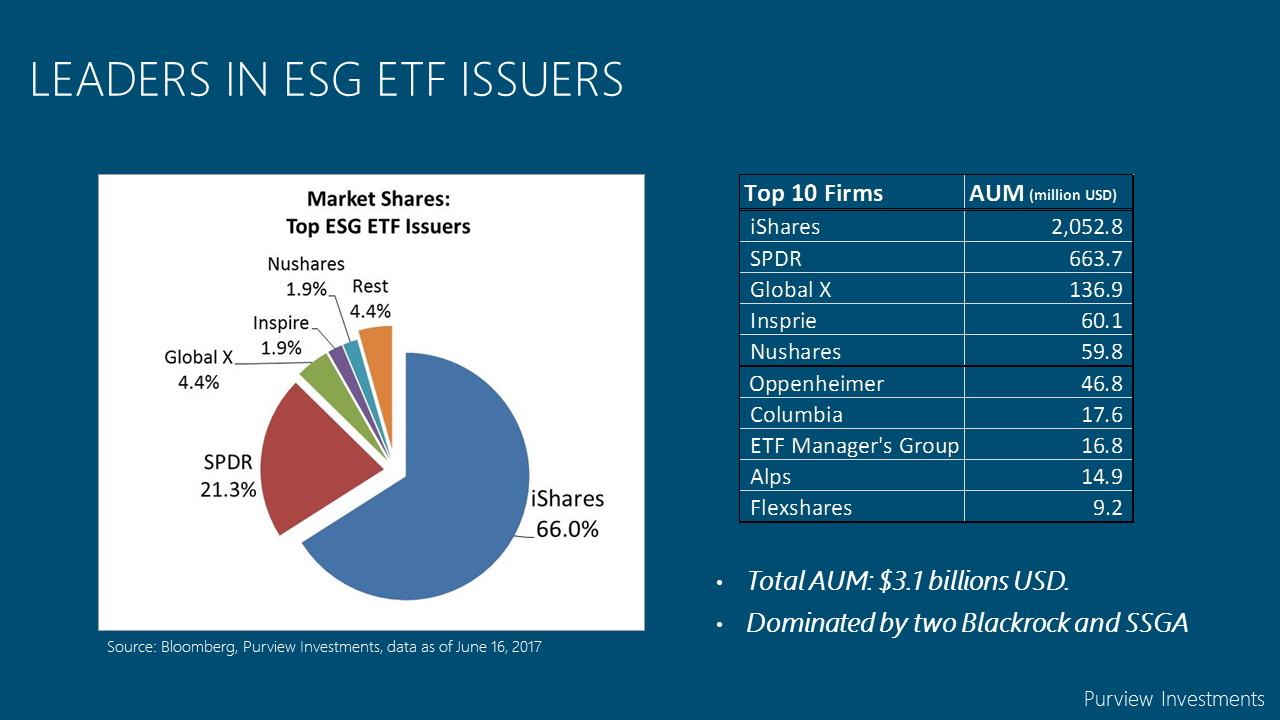

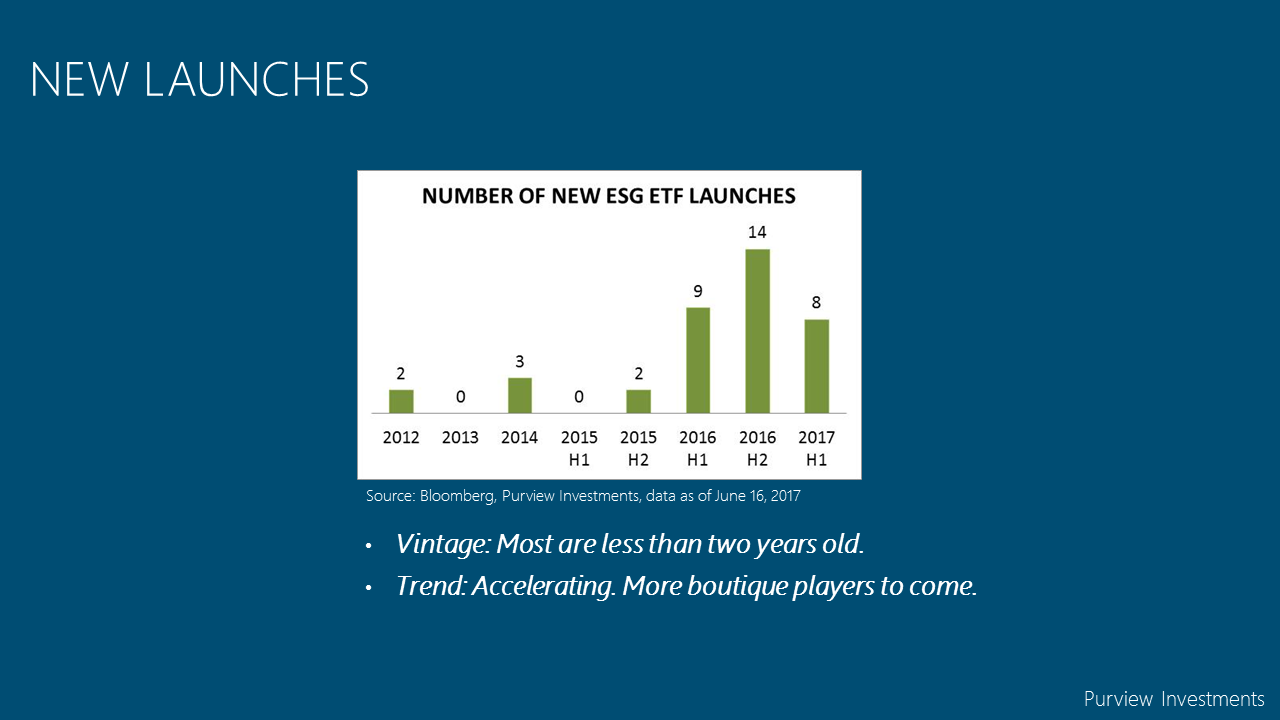

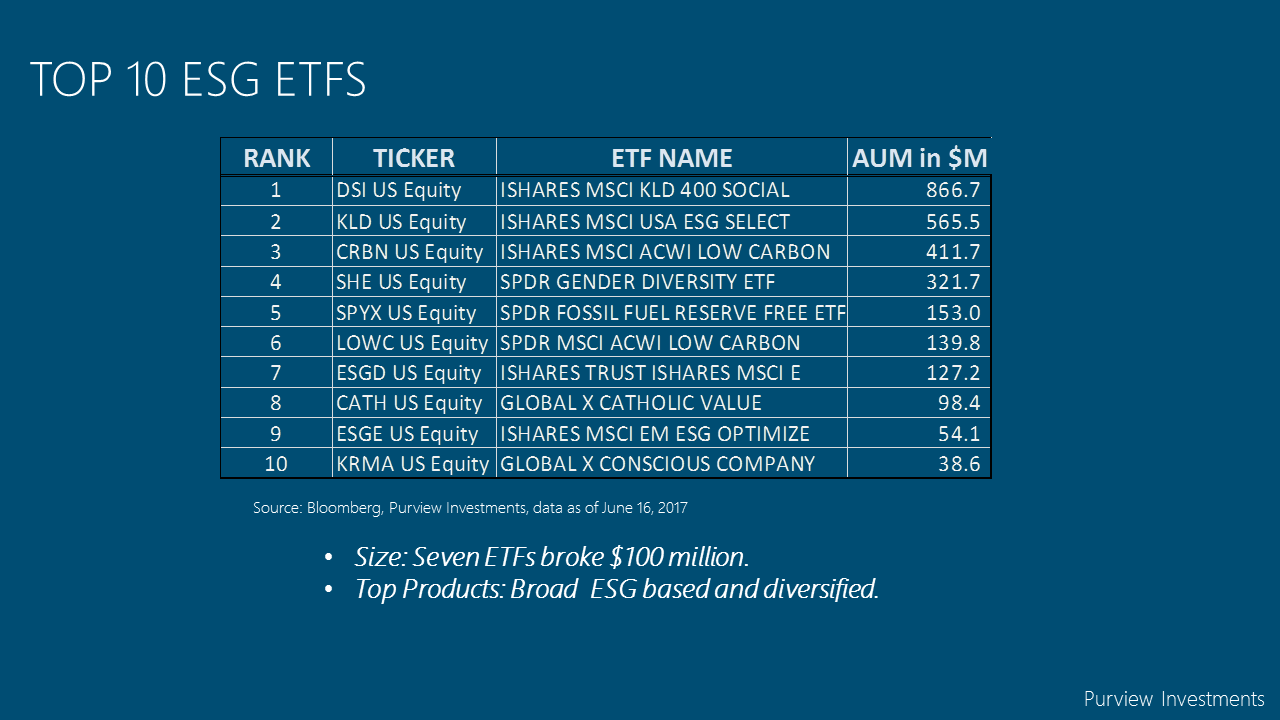

Dr. Zhang shared her recent research on the current state of the ESG ETF product space. This category is young,with 39 US listed ETFs, just over $3 billion in total AUM, dominated by Blackrock iShares and State Street SPDRs. The rest of the top five players may surprise you, with unique angles to ESG. Both Global X and Inspires made their ESG products known for their biblical responsible investing (BRI). Nuveen''s NuShares, on the other hand, are positioning itself with a full range of Russell investment style blocks for asset allocation purposes.

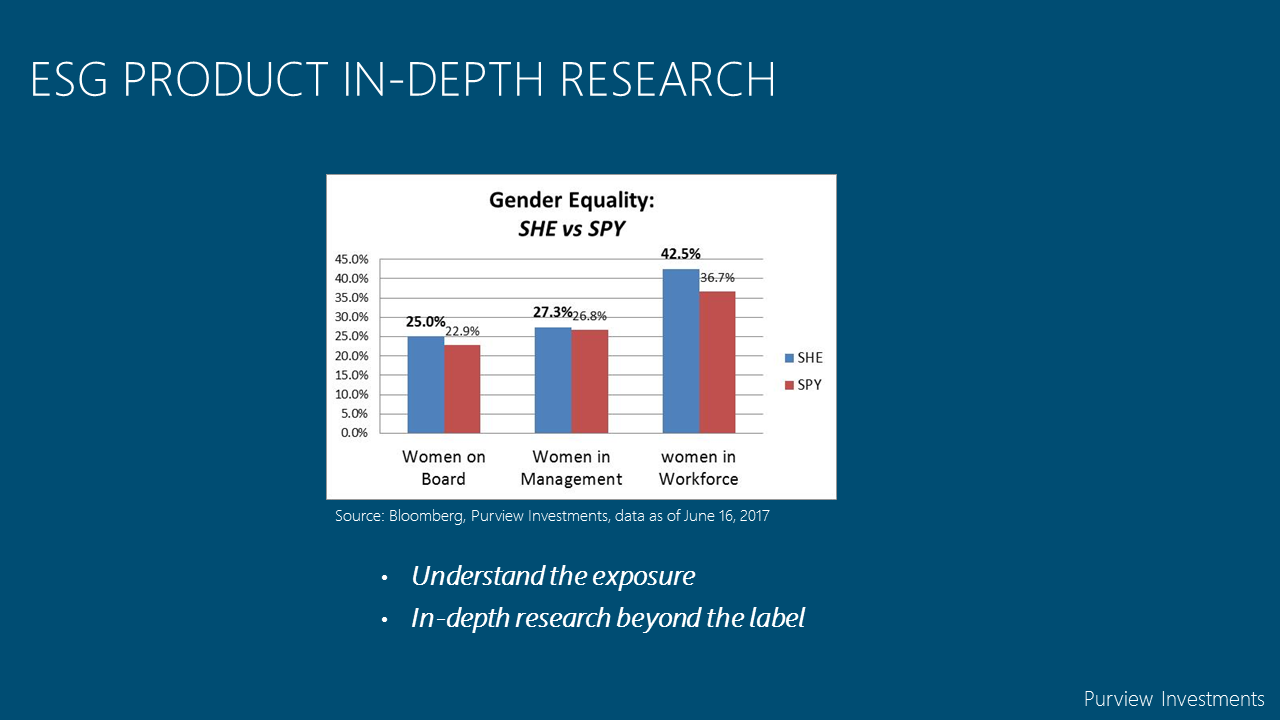

Although the top products focus on catch-it-all ETFs, capturing all aspects of Environment, Social and Governance, single mission ETFs also made to top ten, such as the SPDR's SHE gender equality ETFs, and Low Carbon ETFs by both iShares and SPDR.

Zhang demonstrated the importance and framework of conduct ESG ETF research. Using SHE as a case study, she examined how well SHE is compared with the broad market index on various measures that SHE is supposed to deliver. Find out the answers and other important issues of understanding ESG ETFs from her slides created for the IMN conference.

Footnote: Due to technical difficulty, the slides were not shown during the conference. Zhang is happy to share with the online audience here.

"Here is What Advisors Are Worried About" - Purview Investment's founder Linda Zhang was featured on ETF.com market outlook survey, June 13, 2017

Cinthia Murphy and Heather Bell at ETF.com, have written up their in-depth discussion with several influential advisors across the country about their concerns and expectations for the global capital markets for the second half of the year. Check out the variety of their responses.

http://www.etf.com/sections/features-and-news/heres-what-advisors-are-worried-about?nopaging=1

Purview Investments' Linda Zhang will speak on two panels at IMN Global Indexing and ETFs Conference in Dana Point, CA on June 25, 2017

Two ETF Events You Can't Miss in NYC This Week, June 7, 2017

ETF Trading and Market Structure, hosted by ETFGI's Deborah Fuhr, June 7, 2017

http://etfgi.com/news/events

Inside Smart Beta ETFs, catering to institutional investors, hosted by Matt Hogan at Informa, June 8, 9, 2017

https://finance.knect365.com/smart-beta/

Two ETF Panels at NYC QWAFAFEW Night, May 23: Purview Investments' Linda Zhang, moderated a panel on "How ETFs Bring New Life to Quantitative Investing"; Toroso's CIO Michael Venuto on TETF Index.

Panel 1: How ETFs Bring New Life to Quant Investing

The growth of ETFs is rapidly changing the landscape of the asset management industry. For two years in a row, ETFs have brought in record net inflows, while mutual funds experienced substantial net outflows. Since ETFs are often rules-based, this has helped shift the power struggle from fundamental analysis to quantitative approaches to investing in the industry. Linda assembled three ETF industry veterans to discuss how the growth of ETFs has brought back new life to quant investing at the sold-out NYC QWAFAFEW event. The distinguished guest speakers included:

Joanne Hill, Proshares; Dave Nadig, CEO, ETF.com; Sebastian Mercado, Deutsche Bank

The panel addressed four broad issues: the state of the quant ETFs, the blessings, the limitations and finally, the business and career opportunities. The last point was particular pertinent to the audience - what does it mean for the traditional asset management firms' future businesses and the career choices for the quant talents on the traditional buy and sell sides.

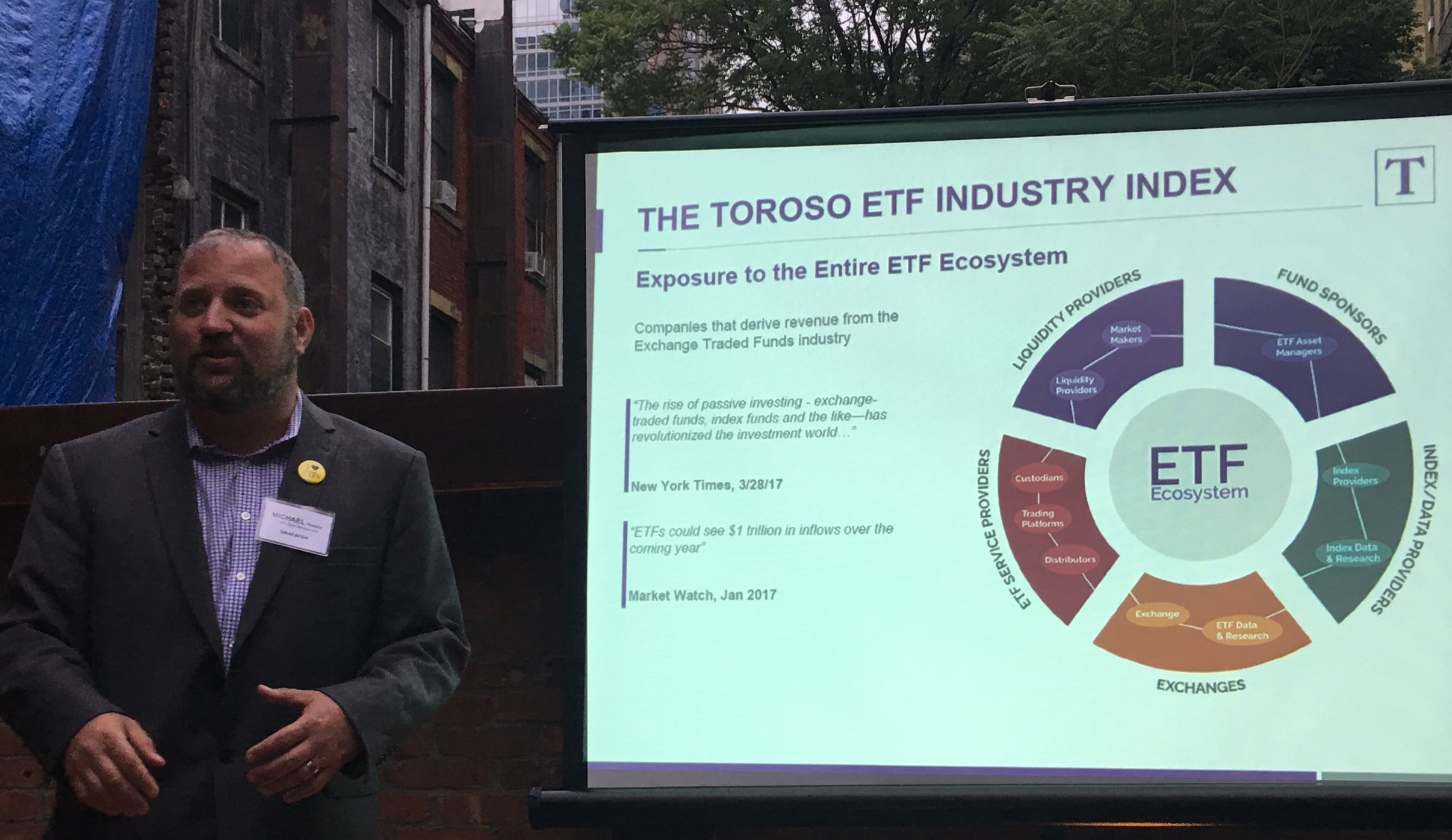

Panel 2: TETF Index: An Efficient Way to Gain Access To ETF Industry

Michael Venuto, Toroso Investments' CIO, on the efficient way to experience the growth of the entire ETF ecosytem that goes much beyond ETF issuers.